How much life insurance do I need?

The question is not really how much life insurance you need, it is how much money your family will need after you are gone.

Everyone’s financial circumstances and priorities are different but here are some questions to help you focus:

- How much money will your family need to meet immediate expenses such as funeral expenses, legal fees and outstanding debts and mortgage balances?

- How much money will your family need to maintain their standard of living over perhaps several years? This could include everyday living expenses, money for a child’s post secondary education, or your spouse’s retirement.

The key to determining how much life insurance you require is really taking some time to do some research. Here are some steps to help with this evaluation:

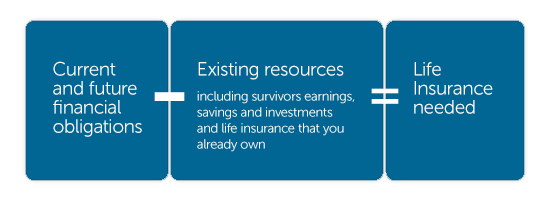

- Gather all of your personal financial information and estimate what each of your family members would need to meet current and future obligations. This would include items such as funeral expenses, mortgage payments, car loans, credit card debt, education expenses, and replacement of your income.

- Tally up all of the resources that your family members could rely on to support themselves in the event that you pass away. Are there any savings or another income to rely on?

- Determine what the difference is between point #1 (obligations) and point # 2 (resources).

This research will be the starting point for determining how much life insurance you actually need. After that, it is time to get further guidance and assistance from a qualified financial advisor. They will be able to tweak your research even further to reflect your personal circumstances, and from there come up with a customized financial plan to provide the necessary security for you and your family.

Did You Know?

On a monthly basis, life insurance can cost less than a cup of coffee?

Consider this

$84/month for coffee1 vs. $11.70/month for life insurance2

Buy NowWatch a Video

1

Based on a cup of coffee at $2.45, purchased 31 days per month.

2

Initial monthly cost for a healthy, 30 year old female, non-smoker purchasing $250,000 of Empire Life Simplified 10 term life insurance as of January 31, 2023. Premiums increase every 10 years.